The OGM Interactive Canada Edition - Summer 2024 - Read Now!

View Past IssuesMobile/digital wallets have become a mainstay of online payments within a short period of time. According to the numbers presented by SafeBettingSites.com, mobile/digital wallets will account for 53% of the entire e-commerce transactional volume by 2025.

Mobile/Digital wallets were unheard of up until a decade ago. However, in a short period, they have become the preferred mode of payment on eCommerce platforms. The other traditional means of payment, such as Credit or Debit Cards, have lost significant ground in the battle of digital payments.

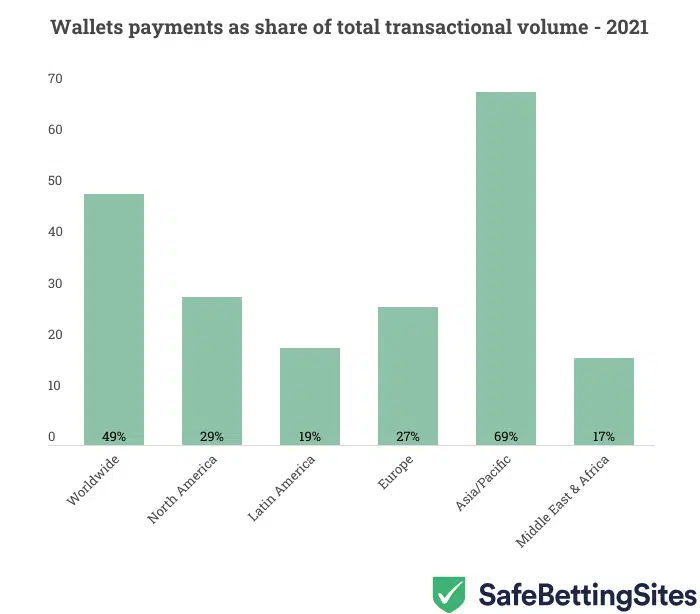

According to the numbers available on Statista.com, 49% of the global e-commerce transaction volume came from digital/mobile wallets. The growth in popularity of wallets is expected to continue, and by 2025, they should account for 51% of the transaction volume.

Credit cards were the second preferred payment method, with only 21% of the market share. Debit Cards were the third-most preferred method, with 13%. Credit and Debit Cards accounted for a combined market share of 34%, which is still significantly short of the percentage of digital/mobile wallets. The share of Credit Cards is expected to drop to 19% by 2025, whereas the share of debit cards is expected to remain the same.

Direct bank transfers accounted for 7% of transaction volume last year. By 2025, bank transfers’ should drop down to 6%.

Buy Now Pay Later (BNPL) payment method is the latest entrant in the digital payment market. 3% of e-commerce payments were made through BNPL in 2021. The popularity of BNPL will continue to grow, and its share should increase to 5% in 2025.

Cash-on-Delivery was a vital payment method in the nascent stages of the e-commerce industry. However, COD only accounted for a 3% share in 2021. By 2025, only 1% of e-commerce payments will be made by COD.

The Asia/Pacific market has been the driving force behind the popularity of mobile/digital wallets. In 2021, mobile/digital wallets accounted for 69% of e-commerce transaction volume in Asia/Pacific.

The North American market was the second most popular for mobile/digital wallets, with a 29% market share. However, Credit Cards were still the preferred digital payment mode, with a 31% market share.

The share of mobile/digital wallets in the European market was slightly lower at 27%. However, wallets were the most popular mode of online payment in Europe.

Mobile/Digital wallets were least prevalent in Latin America and MEA online markets, with 19% and 17% market share, respectively.

Did you enjoy this article?