The OGM Interactive Edition - Summer 2023 - Read Now!

View Past IssuesYesterday, I met Ross Finlay for the first time.

A thinking man, this guy sits back and listens to what you have to say as you present your business ideas to his experienced ear.

A man of many variations, he’s a fifth-degree black belt in karate, he learned to fly at 17 and has been driving motorcycles his whole life. That black belt doesn’t only extend to Karate, it’s also in business success. Ross is the Co-Founder and Director of the First Angel Network and he has been running a business consulting company and a professional association for decades.

Ross started the First Angel Network in 2005. He and co-founder Brian Lowe have connected the dots for over 200 investors and entrepreneurs in Atlantic Canada, equating to the $15.5 million for companies in early-stage development. Ross’s blackbelt business strategies have leveraged over $80 million in follow-up financing for company growth and expansion. He shared his wisdom with me and now I’m passing it along to the entrepreneurs out there who have an idea to bring into the world and want to get it financed. Here’s 7 must know’s to attract your Angel Investor.

As an entrepreneur who wants to attract an investor and/or the right partners to your business, you need to have it together. A well thought out and a solidly articulated plan is the game. Getting your business funded for startup, growth or scaling-up requires understanding these baseline essentials if you want to attract the right partners or investors to your business:

The First Angel Network of Atlantic Canada, defines an Angel investor like this, “An Angel is an Accredited Investor who privately invests their own money in a business, usually in exchange for ownership equity, debt or other terms.”

So Angels have a vested interest in putting their money into other business where they think they will get a return.

Ross says, “When you become a member of the First Angel Network Association, you will join a group of successful business people from around the region who are all Accredited Investors and have a wide range of backgrounds, including CEOs, entrepreneurs, and professionals. They apply this considerable experience to assist our portfolio companies with business strategy and implementation, team building, and raising funds.”

Angel investors invest in early stage or start-up companies because they desire an equity ownership interest in that startup and are looking for a return on their investment. You have to clearly articulate and make the case for the return on investment to the angel.

Angel investing in start-ups has been increasing with the new digital and data era as we see new platforms and innovation like Airbnb, Uber, WhatsApp, and Facebook all flourish into the world. While it’s easy to get caught up in the global success stories, it might be a little more practical to keep your feet on the ground as you get started. The typical angel investment for a startup may be between $10,000 (First Angel Network’s minimum investment) to $100,000 a company but can go higher. In Atlantic Canada, there are other funding support structures for entrepreneurs as well that include organizations like ACOA or IRAP.

Ross says, “Angels don’t see investing in the company or product, as nearly as important as investing in the founder. The vision, passion, integrity, stamina, and commitment of the founder are critical. The founder will need to illustrate to Angel investors the potential a business idea has to overcome initial startup, grow and scale up and will also need to prove their own personal commitment to that growth.

A clearly thought out business plan, and any early evidence of obtaining traction toward the plan is essential to giving the business a boost into success. Ideas must be easy to understand. They must be adaptable, functional and provide value for the consumer.

Entrepreneurs will need:

1. A clearly articulated elevator pitch for the business idea. Can you say it in a sentence?

2. An executive summary or pitch deck. Google “pitch decks” to get it right the first time.

Check out SlideBean.com for great templates like this one featured below.

3. A prototype or working model of the proposed product or service (or at least renditions).

4. Early adopters or customers who have shown interest in the business product or service.

Uber Pitch Deck Template from Slidebean.com

It will almost always take longer to raise angel financing than you had hoped. After all, this is not the Hollywood movies where it all falls into place like Facebook. This is real life. There will be the burden of finding the right investor, meetings, due diligence, negotiations, legalities, business structure, and it all takes time and dedication.

Shares represent the percentage of ownership in a company and they are offered for sale to raise capital for a company generally taking two forms; equity shares and preference shares.

When an individual buys shares in your company they automatically become one of its owners and have a say in who runs the company, its direction and making key decisions on the growth and sale of the company.

Each share forms a unit of ownership of a company and is offered for sale so as to raise capital for the company. Description: Shares can be broadly divided into two categories – equity and preference shares.

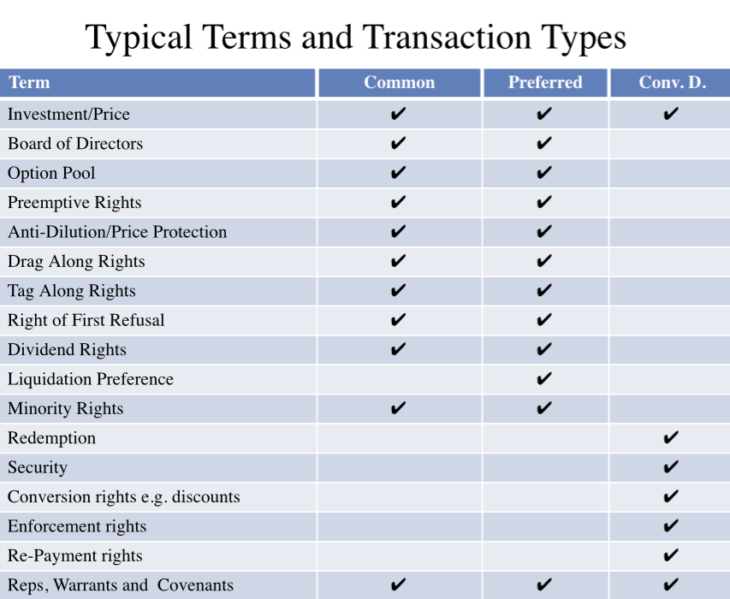

According to Ross Finlay, Angel investors structures deals between entrepreneurs and Angels in three primary ways. Common, Preferred or Convertible Shares. He explains it like this:

COMMON – Common Share Deals make up 51% of the deals in Canada

A common share is a unit of ownership of a corporation. In the case of a public company, the stock is traded between investors on various exchanges. In private companies, there are few opportunities for trade. Owners of common stock are typically entitled to vote on the selection of directors and other important events and in some cases receive dividends on their holdings. The price of the stock moves with the value of the company.

PREFERRED – Preferred Share Deals make up 28% of the deals are in Canada

A preferred share is a stock in which the holder is entitled to a stated dividend/interest rate and also to additional dividends on a specified basis upon payment of dividends to the common stockholders.

Preferred shares usually convert to common shares upon exit and after interest/dividends are paid.

Participating Preferred Stock is a preferred stock that has the right to share on a pro-rata basis with any distributions to the common stock upon liquidation, after already receiving the preferred-liquidation preference.

Preferred Sock is more investor-friendly because when a company must liquidate and pay all creditors and bondholders, common stockholders will not receive any money until after the preferred shareholders are paid out. Second, the dividends of preferred stocks are different from and generally greater than those of common stock.

CONVERTIBLE – Convertible Debt Deals make up 21% of the deals are in Canada

Convertible bonds give the holder of the bond, the option to exchange the bond for a predetermined number of shares in the issuing company. When first issued, they act just like regular corporate bonds, albeit with a slightly lower interest rate.

Because convertibles can be changed into stock and thus benefit from a rise in the price of the underlying stock, companies offer lower yields on convertibles. If the stock performs poorly there is no conversion and an investor is stuck with the bond’s sub-par return

So a convertible security is usually a bond or a preferred stock that can be converted into shares of the company’s common stock. In most cases, the holder of the convertible shares determines whether and when to convert.

A term sheet is a non-binding agreement that provides the basic terms of the Angel investment. You can look at it as the starting point of your negotiations before any legal documents are finalized. It’s your point of agreements and the terms that will be used to move forward.

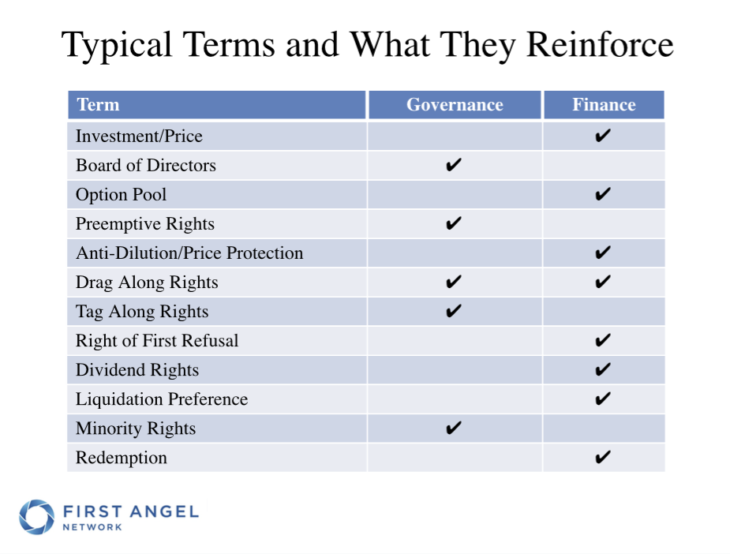

There are two important aspects of how you structure your deal and communicate them through a term sheet: the governance of your deal and the finance of your deal. In other words who has control in the company and what are the financial economics of its viability, success, and scale.

Term Sheets are important because they ensure that there are necessary misunderstandings, disputes or disagreements from the onset of working together. They set parameters which are the foundation of integrity in your deal much like a letter of intent or a memorandum of understanding.

Think of your term sheet as a summary of what is being discussed or offered including the assets, purchase price, contingencies, payments, acceptance periods. Term sheets generally cover the more important aspects of a deal without going into every minor detail and contingency covered by a binding contract. Terms should be ranked on the basis of their importance to the deal as it relates to the Angel and the entrepreneur.

A term sheet may also be used as part of a merger or attempted acquisition. The term sheet typically contains information regarding the initial purchase price offer and preferred payment method, as well as what assets are included in the deal. It may also contain information regarding what, if anything, is excluded from the deal or any items that may be considered requirements by one or both parties. Ultimately the term sheet should mitigate risk to the investor and motivate the entrepreneur to proceed forward.

If all the details of shares and their structures, sounds a little confusing for your entrepreneurial ears, that’s ok. Know the basics, get your sh** together and then reach out to people who know what they’re talking about. People like Ross Finlay who is versed in angel investing, options and strategies to move you forward.

Keep Envisioning, you rock!

__________________________________________________________________________

More on Ross Finlay – Co-Founder, First Angel Network Association

Ross Finlay, a Co-founder, and Director of the First Angel Network Association has been an angel investor since 2000. He has assisted many companies in raising private equity, is a Board Member of the National Angel Capital Organization (NACO), Director of the Angel Capital Association (ACA), and a Trustee of the Angel Resource Institute. Mr. Finlay is a recognized facilitator, senior business consulting professional and strategic change consultant who has an extensive background in public, private and not-for-profit sectors. He has implemented major business changes in a number of organizations and has experience in conducting organizational reviews in the public/private and the not-for-profit sectors. He has extensive business networks throughout Atlantic Canada. He has been Executive Director of a provincial professional association and President of a national consulting company working with scientific, engineering and technical areas. Since his move home to Nova Scotia, Ross has managed his own successful consulting practice. He returned to the corporate world for a time with PricewaterhouseCoopers LLP and SolutionInc Ltd. – a Halifax based software development company. In 2002, Ross was a recipient of the Queen Elizabeth II Jubilee Medal for outstanding community service through his efforts in numerous charities.

Sources: First Angel Network Association, Ross Finlay

____________________________________________________________________________

Tina Olivero – The OGM

Tina Olivero is the Publisher and Content Strategist for clients of the OGM.

OGM stands for OUR GREAT MINDS – you know, that place in our heads where all those great things happen!

Did you enjoy this article?