The OGM Interactive Canada Edition - Summer 2024 - Read Now!

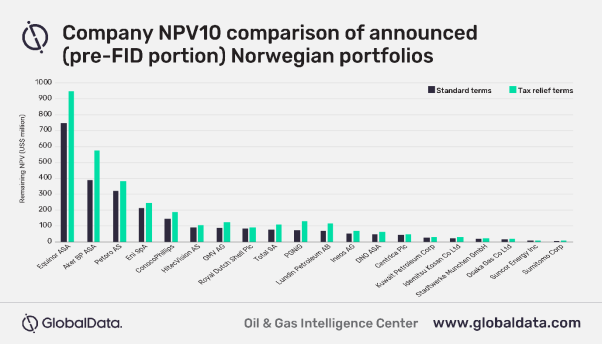

View Past Issues| The temporary tax relief proposal announced by the Norwegian Government, and designed to ensure near-term investment in the country, could double industry post-tax cash flow in 2020 and 2021, which would increase company liquidity in the short term, according to leading data and analytics company GlobalData, a leading data and analytics company. GlobalData’s report, ‘COVID-19 Case Study: Upstream Tax Relief in Norway’, states that following the recent commodity price collapse that has forced companies to reduce near-term capital expenditure, Norway has responded to calls from industry to help sustain investment in the sector. Under the proposal announced, the 78% effective tax rate will remain and instead the Special Petroleum Tax (SPT) allowance depreciation schedule will be accelerated for all investments in 2020 and 2021, and for investment in eligible projects between 2022 and 2024. Toya Latham, Upstream Fiscal Analyst at GlobalData comments: “Of the pre-financial investment decision (FID) fields that are under consideration for development in Norway, and that are targeting FID prior to 2023, Equinor is either the operator or a participant in 16 projects, and therefore could make significant gains if the new terms are introduced. Although Aker BP has interest in fewer fields, the company also stands to benefit with the NPV10 of its pre-FID Norwegian portfolio estimated to increase by almost 50%. There have been early indications that the proposal could be effective. Following the announcement that the government supported the proposal, Aker BP sanctioned the Hod Redevelopment and entered an agreement in principle on the commercial terms with Equinor for a coordinated development of the Krafla, Fulla, and North of Alvheim licenses (the NOAKA project). Previously, this project has been economically marginal and therefore suffered delays. However, the proposal has not yet been fully passed by parliament (it was due for review in mid-June) and civil society groups are attempting to halt the temporary amendment. Latham adds, “Given the relatively constrained timeframe of the proposal, the incentive is only likely to benefit recently sanctioned and smaller projects. For larger projects, such as Wisting, it is possible that a significant portion of investment could fall after the 2024 cut-off, and therefore would not be eligible for the tax relief under the current proposal.” |

Did you enjoy this article?