The OGM Interactive Edition - Summer 2023 - Read Now!

View Past IssuesHusky Energy is significantly reducing capital expenditures and shutting in negative cash margin production as further measures to strengthen its business given market conditions caused by COVID-19.

“We have taken immediate action to preserve our balance sheet and core business in this commodity price environment,” said CEO Rob Peabody. “Our focus remains on health and safety, and on increasing Husky’s resilience.

“As the market rebalances supply with demand over a very short period in North America, negative cash margins before operating costs are occurring. Reducing production minimizes our negative cash margin exposure.”

Husky has important advantages in the current economic environment, including: a strong balance sheet, an Integrated Corridor that includes a sizeable midstream and downstream segment, and Offshore operations underpinned by long-term gas contracts in the Asia Pacific region.

Husky’s plan includes:

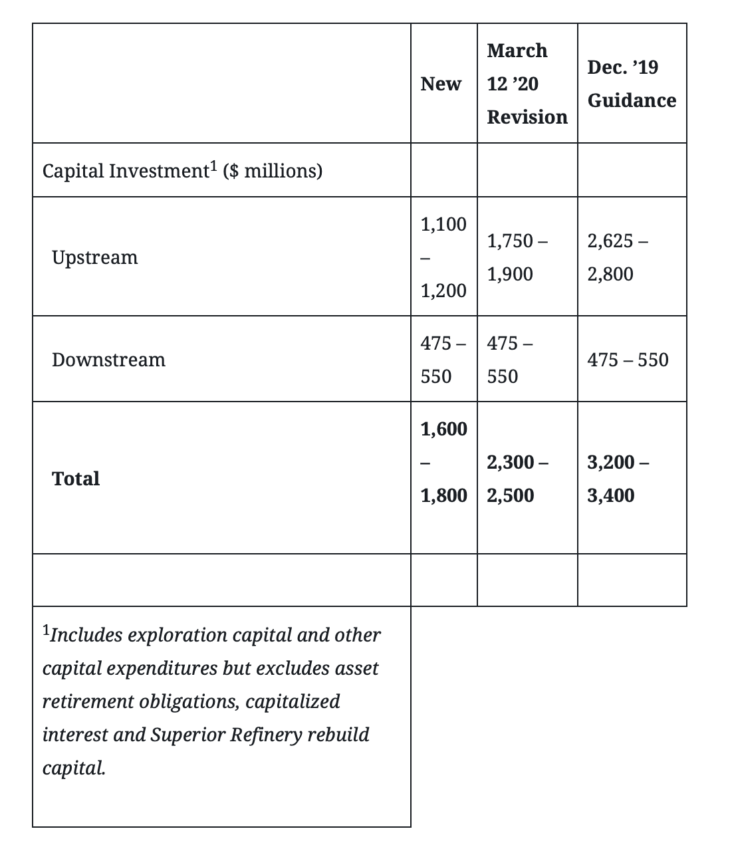

Husky previously announced 2020 spending reductions of $1 billion, including $900 million in capital expenditures and $100 million in cost-saving measures.

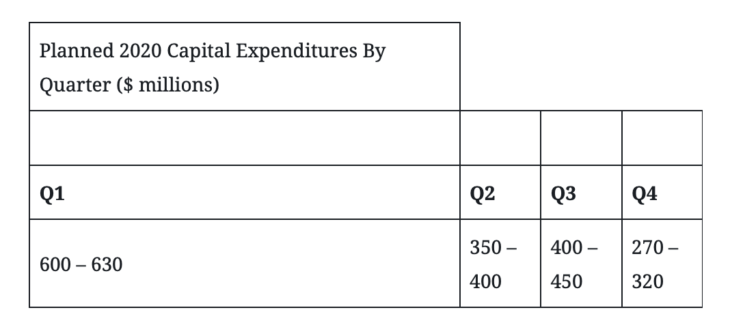

2020 capital guidance is further revised as follows:

Husky continues to safely shut-in production across its Integrated Corridor business, where appropriate. To date, Integrated Corridor production has been reduced by more than 80,000 barrels per day (bbls/day), most of which is heavy oil, with the ability to reduce even further while preserving the option to quickly ramp back up should pricing conditions allow.

Integrated Corridor production is being aligned with upgrading and refining requirements as throughput is adjusted and optimized in line with changing market conditions. As a result, updated 2020 production and throughput guidance will not be provided at this time. Current U.S. refinery throughput has been reduced by around 95,000 bbls/day, or approximately 40% below maximum capacity.

Husky continues to prioritize its balance sheet, supported by significant liquidity. As of the end of the first quarter, the Company had approximately $4.7 billion of liquidity, comprised of $1.3 billion in cash and $3.4 billion in available credit facilities.

Since the end of the first quarter, Husky has increased its liquidity with the recent addition of a $500 million term loan, increasing total liquidity towards $5.2 billion. The term loan proceeds have been used to repay syndicate drawings advanced to repay the maturing 5.0% notes on March 12, 2020.

The Company has no long-term debt maturities until 2022.

A planned turnaround scheduled to begin in April 2020 has been deferred to late Q3 2020, given the current safety and public health risks inherent in mobilizing and maintaining a large construction workforce during the COVID-19 pandemic. Maintenance work at the Upgrader will proceed where necessary and safe to do so, and operations and throughput will be modified in accordance with maintenance requirements.

A project at the Upgrader to increase diesel production from 6,000 bbls/day to nearly 10,000 bbls/day has also been deferred to late Q3 2020.

Rebuild construction at the Superior Refinery in Wisconsin has been suspended due to the safety and public health risks inherent in maintaining a large construction workforce during the COVID-19 pandemic. A schedule for resumption will be determined in due course. Rebuild costs are expected to be substantially covered by property damage insurance.

Lloydminster thermal bitumen production, including the Tucker Thermal Project, has been reduced due to anticipated production backlogs in Western Canada as North American refinery throughputs adjust to the dramatic stall in product consumption.

These types of projects have the flexibility to be safely ramped down to minimum rates and then quickly ramped back up once pricing conditions improve.

Commissioning activities are being completed at the 10,000-barrel-per-day Spruce Lake Central thermal project, with enhanced health and safety protocols in place. Startup will be dependent on improved pricing conditions.

Construction of the 10,000 barrel-per-day Spruce Lake North thermal project, originally scheduled for completion around the end of 2020, has been suspended, and additional Lloyd projects to be delivered beyond 2020 have been deferred.

A major turnaround that was scheduled to start at Sunrise in April has been deferred due to public health and safety considerations related to COVID-19. Other maintenance work at Sunrise will proceed where necessary and safe to do so, with operations and production modified in accordance with maintenance requirements.

Husky operates Sunrise and its partner operates the jointly-owned BP-Husky Toledo Refinery near Toledo, Ohio.

Western Canada oil and gas production is being reduced or shut in. No further capital expenditures are planned in 2020.

Major construction activities related to the West White Rose Project have been suspended due to COVID-19.

Production at the main White Rose field continues, with enhanced workforce control measures designed to ensure safe operations on the SeaRose floating production, storage and offloading (FPSO) vessel. Husky has a 72.5% working interest in the White Rose field and a 68.8% working interest in the satellite extensions, including West White Rose.

The planned drydock for the Terra Nova FPSO vessel is being reviewed by the operator and alternative options are being considered to complete maintenance work and asset-life extension activities. Husky has a 13% working interest in the Terra Nova oil field.

Production at the Liwan Gas Project offshore China has returned to full rates following an extended Chinese New Year break related to the COVID-19 pandemic. Husky has a 49% working interest in the Liwan 3-1 and Liuhua 34-2 fields.

The Liuhua 29-1 field at Liwan is advancing towards first production by the end of 2020. Husky holds a 75% working interest in the field, which once fully ramped up will add approximately 9,000 barrels of oil equivalent per day to its fixed-price Asia Pacific production.

The BD Project in the Madura Strait offshore Indonesia has returned to full rates following planned maintenance in the first quarter. Husky has a 40% working interest in the project.

Due to the current market environment, Husky has suspended the strategic review of its Canadian retail and commercial fuels business, which consists of more than 500 stations, travel centres, cardlock operations and bulk distribution facilities.

Husky is responding to the evolving COVID-19 situation, with safety and health protection plans in place that incorporate medical advice for all its sites. Our priority is the health and safety of our workforce, their families and the community.

We have taken steps to protect our employees and contractors, whether working in the office or in the field. This includes closely following the advice and direction of health authorities and governments, as well as our medical experts.

Those who can work from home are, and we’ve implemented precautionary measures at our field locations. These vary depending on the requirements of the site, however all locations:

We have taken additional steps at projects where there were larger construction or maintenance crews on-site, including suspending major construction activities at the West White Rose Project, suspending construction activities at the Superior Refinery rebuild and deferring a turnaround at the Lloydminster Upgrader.

Individuals approved to work on specific sites are not allowed on-site if they have flu-like symptoms or have been in contact with someone who has tested positive for COVID-19 within the past 14 days. They must also complete Husky’s COVID-19 health declaration.

Read Husky’s Suppliers update (pdf)

To gain access to a Husky facility in Canada, individuals must complete Husky’s COVID-19 health declaration.

myHusky has expanded hygiene and cleaning practices, including increased frequency of cleaning of common, high-contact areas such as countertops, door handles, tables and menus in restaurants, fueling nozzles and pin pads on pumps and in stores. Retailers and their staff have increased cleaning and sanitizing in washrooms and showers. Read more (myHusky.ca)

Did you enjoy this article?