The OGM Interactive Edition - Summer 2023 - Read Now!

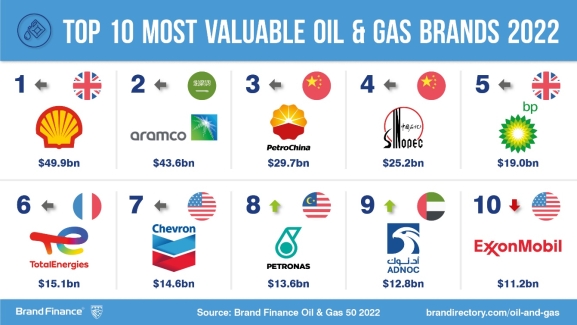

View Past IssuesDespite COVID, the conflict in Ukraine, and increased awareness about ESG causing widespread havoc to the oil and gas sector globally, Shell (brand value up 18% to US$49.9 billion) has not only withstood the global disruption but been able to grow its brand value this year, according to a new report from the world’s leading brand value consultancy, Brand Finance. After a tough two years due to wildly fluctuating demand, the oil and gas sector is powering ahead with the world’s 50 most valuable oil and gas brands achieving an aggregate growth of 8% this year.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes around 100 reports, ranking brands across all sectors and countries. The oil and gas industry’s top 50 most valuable and strongest brands in the world are included in the annual Brand Finance Oil & Gas 50 ranking.

Shell’s brand is increasingly focused on developing an energy transition strategy as it aims to become a net-zero emissions energy business by 2050, in step with society’s progress towards the goal of the Paris Agreement on climate change. While the energy transition brings risks to Shell, it also creates new opportunities for the brand to develop. Increasingly, it appears likely to sustainably lead the global oil and gas industry to transition to a net-zero energy system.

David Haigh, Chairman, and CEO of Brand Finance commented:

“The energy transformation is both the greatest challenge and the greatest opportunity facing the oil and gas sector. The industry can be both optimistic and realistic about the risks and opportunities that lie ahead, but it will be tough for brands to simultaneously navigate the recovery from Covid, the conflict in Ukraine, and broader concerns about environmental sustainability in the future. Shell, Aramco, and others will be challenged to transform in coming years to leverage their brands to deliver for their customers.”

Saudi oil giant Aramco (brand value up 16% to US$43.6 billion) is the world’s second most valuable oil and gas brand and has substantially recovered its brand value lost during the pandemic. Aramco has been serving significantly increased demand for oil and gas products, correlated with large fiscal stimulus programs initiated around the world last year.

The increase in demand saw Aramco’s third-quarter profits more than tripled year-on-year, helping push its market valuation to US$2 trillion. In a sign of confidence and ambition for continued growth, Aramco announced plans to increase its production capacity from 12 million barrels a day to 13 million by 2027. The company has continued to invest heavily in its brand to support growth in both core and growth businesses through a global campaign as well as investments in sports – from Formula 1 to golf.

Aramco is well placed to drive significant further brand value growth supported by surging commodity prices driven by the recovery in global energy demand as key economies reopen and travel restrictions ease amidst higher COVID-19 vaccination rates around much of the developed world.

Abu Dhabi National Oil Company (ADNOC) continues to achieve significant ongoing growth in brand value, having delivered 174% growth in brand value since the start of its brand transformation journey in 2017. This year, its brand value is up a further 19% to US$12.8 billion, and ADNOC has improved its ranking by one place to become the ninth most valuable oil and gas brand in the world.

Beyond the oil and gas sector, ADNOC was also the UAE’s most valuable brand overall, and the second most valuable brand in the Middle East region. With an eye on the future, and in line with the UAE leadership’s 2050 net-zero strategy, ADNOC is embracing the energy transition through several strategic initiatives including its global clean energy joint venture with TAQA and Mubadala on renewable energy and green hydrogen. The ADNOC brand is also likely to benefit from UAE’s effort to become a global sustainability leader as the nation plans to host COP28, the 2023 UN Climate Change Conference.

Further, ADNOC’s Dr. Sultan Ahmed Al Jaber is the top brand guardian CEO for the global oil and gas sector according to Brand Finance’s Brand Guardianship Index. Since becoming ADNOC’s Group CEO in 2016, Dr. Sultan has led a rapid and comprehensive transformation of the business, strengthening the company’s overall performance and helping to foster a more commercial mindset.

As the CEO of one of the world’s leading oil companies, Dr. Sultan has taken a progressive yet pragmatic position in relation to the global energy transition; extending ADNOC’s legacy as a responsible oil and gas producer, by further reducing the company’s carbon intensity, while driving investment in new energy technologies, such as hydrogen. Within the Brand Guardianship Index, Dr. Sultan performs particularly well on “strong strategy & long-term vision, net positive online coverage, and employee approval rating. Since Dr. Sultan became CEO of ADNOC in 2016, the ADNOC brand value has grown by 22% per year on average.

In China, the largest two oil and gas brands remained PetroChina (brand value down 6% to US$29.7 billion) and Sinopec (brand value down 5% to US$25.2 billion) which were ranked as the third and fourth most valuable brands globally. Each of the challenges faced by Western oil and gas brands has been exacerbated in China: the continuing COVID curtain of restrictions has subdued demand for oil and gas products.

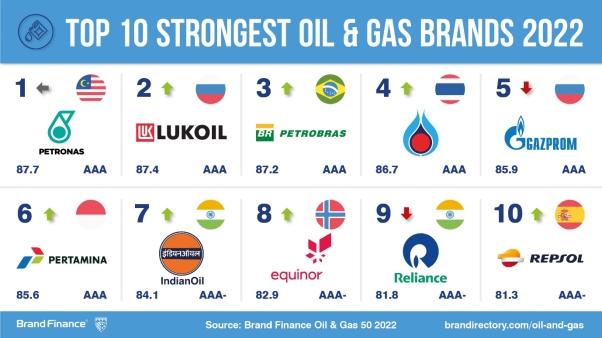

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in more than 35 countries and across nearly 30 sectors. Petronas (brand value up 13% to US$13.6 billion) is the strongest brand in the ranking with a Brand Strength Index (BSI) score of 87.7 out of 100 and a corresponding brand rating of AAA.

Petronas is well placed to further strengthen its brand as it aims to sustainably provide a diversified range of energy options and fuels as it targets net-zero carbon emissions by 2050.

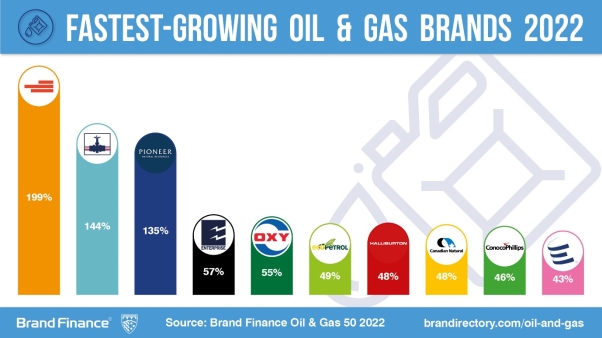

Devon (brand value triples to US$2.3 billion) was the fastest-growing brand globally in the oil and gas sector. Devon’s brand value tripled and was ranked as one of the top 50 oil and gas brands in the world for the first time as a result of the completion of its merger with peer WPX Energy last year. As a result, the combined brand value has increased substantially, with the combined brand focusing on onshore exploration and drilling in the continental USA, primarily in the Delaware Basin of Texas, and to a lesser extent, operations in New Mexico and North Dakota. The brand is benefiting from higher commodity prices and an increased focus on addressing environmental, social, and governance priorities.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance for more than 25 years, Brand Finance evaluates the strength of brands and quantifies their financial value to help organizations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes nearly 100 reports that rank brands across all sectors and countries.

Brand Finance is a regulated accountancy firm, leading the standardization of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Did you enjoy this article?